This post originally appeared on the Misbehaving Blog, powered by ideas42 and the Center for Decision Research at the University of Chicago.

Two economists are walking down the street. One sees a $20 bill lying on the sidewalk and says, “Look at that $20 bill!” The second economist responds, “Nah, that’s not a $20 bill. If it was, someone would have picked it up already.”

From flu shots to home energy audits to government assistance, there are arguably plenty of “$20 bills” out there for the taking. On the face of it, these programs are a no-brainer for potential beneficiaries: they are generally free, widely available, and impose few transaction costs. In a rational world, such programs would be used by close to 100% of those eligible.

However, many people seem to ignore these opportunities. Only 42% of eligible individuals claim benefits from the Temporary Assistance for Needy Families program. Only 55% of those eligible take advantage of the Supplemental Nutrition Assistance Program (also known as “food stamps”). Only 46% of those eligible access Supplemental Security Income. Why aren’t people stopping to “pick up” this free cash?

A recent paper by Saurabh Bhargava and Dayanand Manoli in the American Economic Review, titled Psychological Frictions and the Incomplete Take-Up of Social Benefits: Evidence from an IRS Field Experiment, explores the low take-up puzzle in the context of the U.S.’s largest cash transfer program, the Earned Income Tax Credit (EITC). Unlike most transfer programs, the EITC is administered through the income tax system. Here’s how it works, in a nutshell: if you earn below a threshold in a given year, you are eligible for a cash transfer from the government that is disbursed just as a tax refund would be. The maximum amount of these credits ranges from $487 for individuals without children to $6,044 for individuals with three or more children. Given the low transaction cost of filing for the EITC (filling out a form, basically) along with your tax return, the EITC seems like a great deal.

Yet the EITC is neglected by an estimated 6.7 million eligible people each year – 25% of the population of eligible individuals. Why is this happening? Is it stigma about claiming? Confusion about the program or its benefits? There are many possible explanations, but not so many answers.

In the paper, the authors report on a field experiment they conducted with the IRS. They sent mailers reminding eligible individuals who had yet to access their EITC benefits to do so. They targeted a group who had not responded to a reminder mailer sent by the IRS (which we will call the “pre mailer”) just months earlier – so these were people who, ex-ante, seem like they’d be hard to motivate. To test several hypotheses for low take-up, the authors varied the mailers’ content and design and tracked recipients’ post-mailer take-up of the EITC. The authors used both a control mailer, which was a simplified version of the pre mailer, and a variety of treatment mailers that altered what information was presented and how it was displayed. The authors were particularly interested in understanding how informational complexity, perceptions of the benefits of the EITC program for recipients, and stigma factored into take-up rates.

What did they find? First, the new mailers significantly increased take-up: 22% of individuals sent some version of the new mailer signed up for the EITC in response. This may not seem like a lot, but given that these individuals had only months earlier received a similar reminder mailer, the effects are notable. Why were these new mailings so effective? The findings suggest a few possible behavioral factors. First, simplicity was key. Indeed, only 14% of individuals receiving a “complex” treatment mailer (which featured both a complex notice and a complex worksheet for EITC enrollment) responded by signing up for the EITC. Meanwhile, those receiving the control mailer, which displayed similar information but used a readable font, cut repetitive content, and used a cleaner layout than the complex mailer, responded with 23% sign-up. This boost in response rate from simplification was especially high for the lowest-income workers, who had roughly twice as large of a response to mailer simplification as did recipients above median income. In short, simplification matters – and it matters most for the people who have the least.

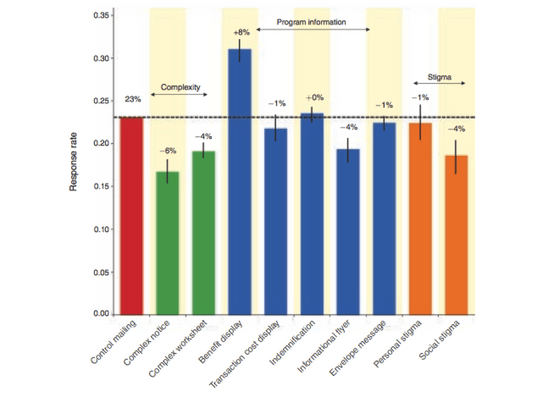

Various aspects of mailers and their contribution to response rates (the dotted line enables comparisons with the control mailing, visible in red).

Second, focusing extra attention on benefits was a particularly successful strategy. Mailers that included a salient “price tag” that told people how much money they were eligible to receive were associated with an eight percentage point greater response rate than the control mailer (this is visible in the fourth bar in the figure above). Surprisingly, the inclusion of a brief message aimed at reducing the stigma of claiming EITC benefits (by noting that the credit is an earned reward for hard work) had no effect on claim rates (this is visible in the orange bars in the graph above, which are not notably different than the red, control bar).

So, rather than being influenced by time costs or perceived social stigma, individuals seem to neglect the EITC more when they find it harder to understand what the program offers and how to receive their share. As it turns out, it’s the mere mental hassle of understanding the complexities of the program that is holding people back. Previous work on poverty alleviation, by the nonprofit organization ideas42 among others, suggests that this is a common issue for individuals working with scarce resources, who are often too occupied with immediate needs to break down complex forms and figure out whether they could/should apply for a given social program.

Luckily for policy makers, this problem has an easy solution. By offering individuals a simpler presentation of information about eligibility and a clearer highlighting of the perks, policy makers are likely to increase take-up of important social programs. That means more people will get the help they need – and the government can stop wasting money chasing people down to give them free cash.

Turns out we just need to remember what the U.S. Navy and others have referred to as the “KISS” principle: Keep It Simple, Stupid. Indeed, when it comes to take-up of social programs, keeping it simple seems pretty smart.