If you don’t own coal stocks or invest in pipeline companies, you may not think of yourself as a fossil fuel funder. But U.S. banks are the biggest lenders and underwriters of fossil fuel projects globally, meaning the money in your checking and savings accounts could indeed be funding projects like deep-water drilling, pipeline expansion, and tar sands oil extraction.

The good news for those concerned about such realities is that alternatives exist. A growing number of financial institutions have pledged to avoid funding fossil fuel infrastructure, now and in the future. Concerned consumers can switch to ‘climate-friendly’ institutions in order to better align their financial decisions with their environmental values. Moving money into climate-friendly institutions reduces the capital available for financing fossil fuel companies, and signals to the financial sector more broadly that a sustainable future matters to many customers.

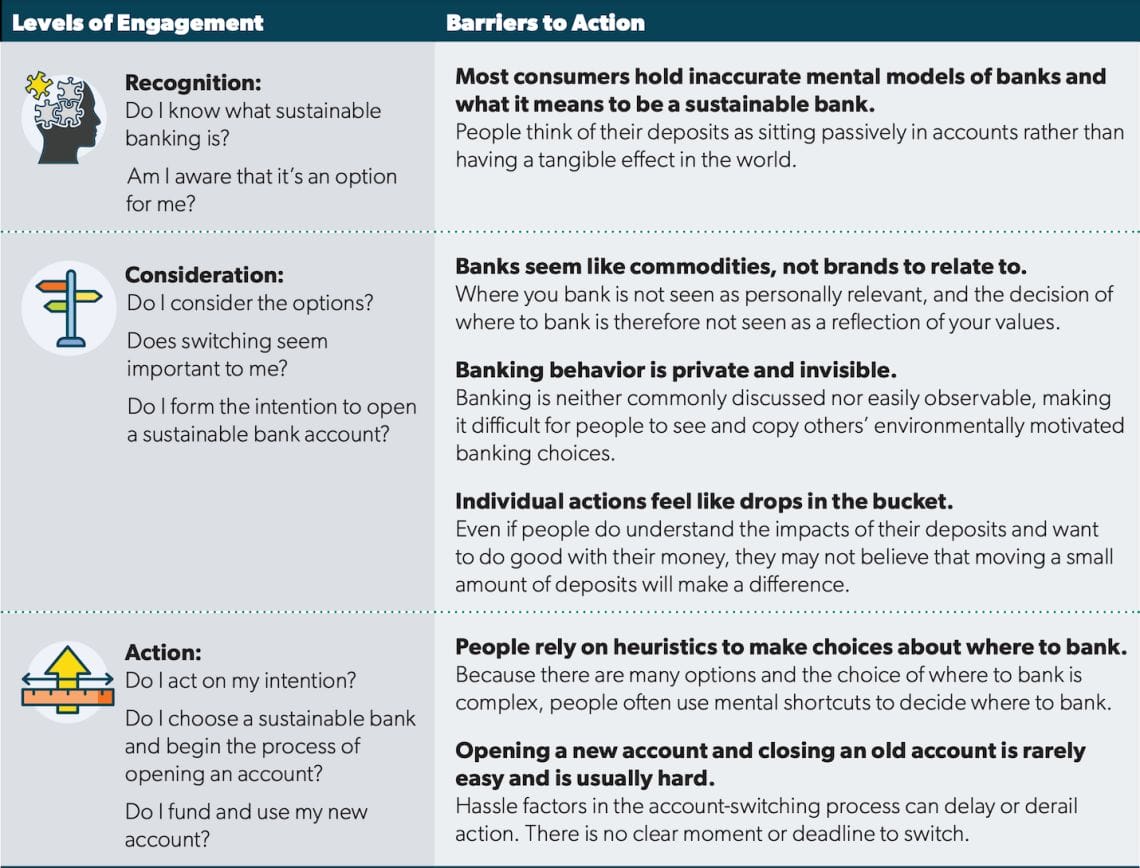

But few consumers—even those who care deeply about the climate—have made the switch to a “sustainable” deposit account. In 2019, we identified several behavioral barriers contributing to this. Unsurprisingly for those familiar with behavioral science, we found significant last-mile barriers as motivated consumers who wanted a new bank still struggled to follow through on that intention.

But the challenges were bigger than intention-action gaps. For example, we found that many people had misperceptions about banking in general and what sustainable banking meant, and they underestimated the collective impact of taking action. Switching to a climate-friendly bank wasn’t even on the table for most folks.

Main behavioral barriers that prevent well-intentioned consumers from switching to sustainable bank accounts (ideas42, Bank on What You Believe).

First: what is a sustainable bank?

Organizations and advocates often attempt to get others to take action on an issue with education or awareness campaigns. It’s a classic error. Evidence shows that more information alone doesn’t usually lead to action, and often individuals already have the understanding they need. But in this case, we did see evidence of an awareness (or recognition) problem standing in the way of behavior change: in our initial research, interviewees thought sustainable banks were the ones that offered paperless statements, and saw choosing where to bank as a value-neutral decision. Even among activists, many large banks had been labeled “bad,” but there was little guidance about what banks were “good.”

So we partnered with Purpose, Fernandez Advisors, Presente.org, Sol Nation, and Grow Brooklyn to launch Bank for Good, a consumer-facing effort to inform people about the existence of banks near them that would be suitable options for switching to sustainable deposit accounts.

The coalition designed Bank for Good with racial, economic, and environmental justice as core parts of its effort. Communities of color have experienced historic discrimination from financial institutions and disproportionate impacts from climate change and polluting facilities. Because we were working at the intersection of finance and climate, this approach was critical. For example, Bank for Good’s messaging and brand identity emphasized the connection between racial and climate injustice, and the bank filtering tool included the ability to search for Black-owned or -led institutions.

The resulting campaign and website, bankforgood.org, leverages behavioral insights, as well as proven marketing and organizing principles, to make it clear to consumers what sustainable banking is, why it matters, and how to make the switch.

Bank for Good: raising awareness and creating tools to make switching banks easier

Like many campaigns, Bank for Good aims to raise awareness through a strong brand identity and marketing on social media and news outlets. Purpose developed and tested seven research-driven message strategies that addressed recognition barriers by focusing on why sustainable banking matters. Testing showed that messages about social justice and increased community power drew the most engagement, compared to messages that focused on other aspects of climate action and impacts. While this might seem counterintuitive, other research has found similar outcomes — talking about the climate crisis directly is rarely the most effective way to prompt action.

Bank for Good also, crucially, provides its audience with clear guidance on better banking options. Paid media and partner messaging directed individuals to bankforgood.org, where design features aim to reduce the hassles of finding and opening an account with a climate-friendly financial institution. Users can easily search financial institutions pledging not to fund fossil fuel projects, and filter to find one that matches their specific needs (e.g. physical location and account features), and values (e.g. Black-owned or -led, Community Development Financial Institutions, and/or B-Corp institutions). We also offer a simple text message reminder signup to help coach people through the arduous switching process.

More is needed to overcome hassles of making the switch

In the end, despite high levels of engagement with the marketing campaign, the number of new accounts actually opened was limited, and few visitors signed up for the reminder tool. We did see more action among users who saw ads more than once, suggesting people may need more time and repeated exposures to act.

This isn’t a surprise — while the campaign did help raise awareness, we know that the last-mile problem of converting intention into action is critical. Good intentions are not enough for consumers to follow through on opening a new deposit account; urgency is lacking. Most significantly, the real-life hassles associated with making the switch to a new bank account remain high.

Our website and reminder tool are not enough to overcome these challenges. Solutions that directly reduce these barriers should be a priority; for example, policy changes can help increase the portability of consumer financial data, and make it easier to close one account and open another.

Sustainable banking and behavioral science going forward

Bank for Good will continue to look for and prioritize opportunities to drive highly activated audiences, seeking to align their financial decisions with their values, to bankforgood.org. For example, the Bank for Good financial institution search tool has been embedded into the Stop the Money Pipeline website, so the coalition can help their members more quickly and easily find an account aligned with their needs and values. We aim to work with a wider range of partners to increase use of the tool at a broader scale. Importantly, we will also test additional behavioral innovations to address the lingering intention-action gap for consumers interested in switching to sustainable deposit accounts.

To learn more about our work in sustainable banking, check out our insights presentation and recording. If you would like to be part of Bank for Good’s next phase, would like to embed our search tool on your website, or are interested in more of the specific insights gained from the campaign, please reach out to the team at sustainablebanking@ideas42.org.